We all want our loved ones to feel cared for as they age, but that doesn’t always mean we’re ready when we’re called to help. And with Americans living longer, it’s becoming a reality for more families every day. In fact, it’s estimated that by 2034, adults aged 65 and older will outnumber people under 18 for the first time in US history.1 That’s a big shift, and it means more people are stepping into the role of caregiver for aging parents, partners, and loved ones.

Being a caregiver can be deeply meaningful, but also full of surprises. From helping with daily routines to navigating finances, there’s a lot to figure out along the way. And if you don’t have someone to talk to who’s been through it, it can feel like you’re all on your own.

That’s why we put together this list of 9 things you might not know about caregiving—to help you feel a little more prepared, and a little less alone.

1. Women aren’t just more likely to be caregivers—they’re also more likely to need care

If you guessed that women often end up as caregivers, you’re spot on. In the US, there are about 37 million people providing unpaid eldercare—and nearly 60% of them are women.2 Many are part of what’s called the “sandwich generation,” juggling care for both their kids and their aging parents. With so much on women’s plates, their own needs can take a backseat.

But here’s something to think about: Women are also more likely to need care themselves down the road. In fact, they make up roughly 70% of people in assisted living.3 So while women have a lot on their minds between work, life, and caregiving, it’s also important that they take into consideration their own wishes and financial plans for future care.

2. Caregiving can have hidden costs

Caregiving can be fulfilling, but it also comes with some emotional, physical, and financial challenges. On the money side, a lot of caregivers, especially women, find themselves stepping in to help during their peak earning years. And that can take a toll. Whether it’s cutting back hours, turning down new opportunities, or even taking a leave of absence, caregiving can impact your career and income. Over time, that can make it harder to save for the future—things like retirement, paying down a mortgage, and other long-term goals. And remember, if you're not working, you're not contributing to your Social Security, which means your benefits may be lower in the future.

So if you’re thinking about helping your parents or other aging loved ones, be proactive and consider planning for how becoming a caregiver could affect your finances too.

3. It can mean different things to different people

Caregiving needs tend to vary from person to person, but when it comes to caring for aging loved ones, a simple way to think about it is in 2 categories: physical and financial.

Physical caregiving includes the assistance someone might need to help live their daily life. Examples include in-home help, adult day care, assisted living communities, memory care, and more.

On the other hand, financial caregiving is managing another person’s money and making decisions on their behalf. Just like with physical caregiving, your role depends on how much support your loved one needs. It can include gaining access to accounts, budgeting, figuring out how to pay for care, as well as other day-to-day money logistics. As a financial caregiver, you might be helping determine how long your loved one’s money may last, paying bills, monitoring accounts, or filing taxes.

Both physical and financial caregiving can take a lot of time and energy. So it’s key to build in ways to care for yourself too.

4. Talking about aging doesn’t have to be hard

Whether you’re currently a caregiver or thinking about care you might need one day, it’s a good idea to get on the same page as your loved ones. That way, you can start gathering important documents and planning together. You’ll want to take the time to talk through the big stuff, things like finances, quality of life, housing, care preferences, and end-of-life wishes.

Talking about aging isn’t always easy, and it can be tempting to put off these conversations. But having them sooner rather than later can make a big difference for you and those you care about in the long run. As a caregiver, you want to make sure that you know what is important to them, so you can come together to create plans that meet their needs and wishes.

Here are some tips to help get you started:

- Educate yourself first: The more you understand going into the conversation, the more confident and prepared you’ll feel.

- Be clear about your intentions: Let your loved ones know you care and that you’re coming from a place of support.

- Take your time: You don’t have to cover it all in one go. These conversations can unfold over time.

- Ask what matters most to them: You won’t know if you don’t ask, and you might be surprised by what they share. Keep an open mind and really listen.

Life happens and plans can change, so make sure you check in regularly. Having conversations early and often can help take the pressure off and even bring you closer together.

TIP: Our Aging well guide can help you talk through a loved one’s wishes.

5. Where you store your documents matters

There are a number of legal documents that can help with caregiving and you may want to get them into place early. These include:

- Power of attorney: Grants authority to another person to make certain decisions on your behalf, including access to bank accounts and paying bills.

- Health care proxy: Names another person to help make medical decisions on your behalf when you are no longer able to.

- HIPAA authorization: Allows your health information to be disclosed to a third party.

- Living will: Lets you state your wishes regarding certain medical treatment and life-prolonging and end-of-life care.

Of course, these documents are only useful if you know how to get to them when you need them. So you want to make sure they are as secure and easy to access as possible.

You might be wondering, what about a safety deposit box? While the extra security is tempting, it can be hard to access its contents in an emergency, after bank hours, or without the appropriate authorizations. You’re likely better off with a digital option, or an at-home safe.

TIP: FidSafe® is an easy, no-cost, and secure way to digitally store, access, and share important documents.

6. Costs of long-term care tend to increase each year

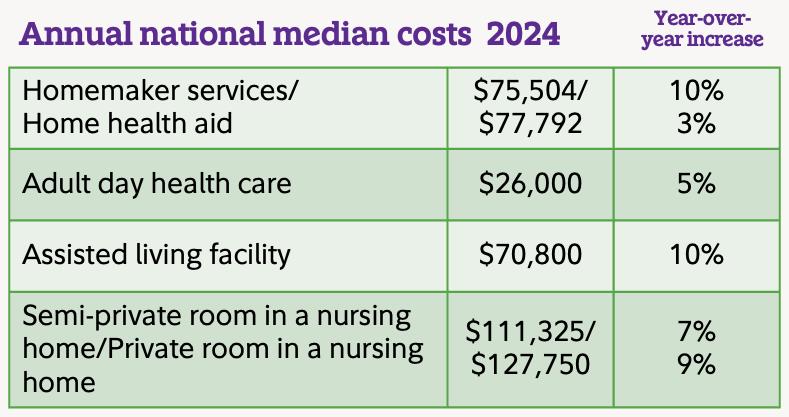

Long-term care costs depend on where you live, how long you need care for, your needs, and other factors. This table can give you an idea of care costs today, as well as how much they’ve gone up in the last year. Typically, the more involved the care, the more expensive it is.

It’s important to know that there’s a difference between health care and long-term care. While health care includes costs like doctor’s visits, prescriptions, and other medical care, long-term care includes support for those who can no longer perform everyday activities like bathing and eating on their own. You’ll want to save for each like you would for any goal, to help make sure health care and long-term care expenses are not surprises you have to deal with later.

7. Medicare isn’t enough—you likely need other ways to pay

A common assumption is that Medicare will pay for your long-term care costs, but the reality is that it doesn’t cover most. And since long-term care can be one of the largest expenses in retirement (along with health care), it should be part of your overall financial plan.

Here are 2 common ways to pay for long-term care:

- Personal savings: You may want to consider tax-advantaged ways to save for long-term care. One option is a health savings account (HSA), which allows you to contribute money tax-free, which potentially grows tax-deferred, and in the future you can take tax-free withdrawals for qualified medical expenses, including those related to long-term care.4

- Long-term care insurance: Both traditional and hybrid long-term care insurance allow you to pay premiums today so an insurance company will help cover the costs in the future. Which you choose depends on your individual needs.

TIP: Learn more about how to create a plan to cover your long-term care costs with hybrid life insurance with long-term care.

8. If you’re single, you may need to plan differently

First off, if you’re thinking about how to plan for your future solo, you’re not the only one. There are about 15 million single agers in the US without children.5 Single or widowed people are more likely to need outside help, and as we shared above, this is especially true if you’re a woman.

Here are a few things to consider:

- You may want to hire a patient advocate, who can help you navigate the medical system as you grow older.

- You might benefit from paying special attention to who you want to make financial or health decisions for you if you’re not able to.

- It’s equally important for you to have your wishes documented, and to share them with people in your life that you trust.

TIP: Read up on 6 money considerations for single women.

9. A financial professional can help you plan

Wrapping your head around caregiving and everything that comes with it can feel overwhelming. But you don’t have to figure it out on your own. A financial professional can be a neutral voice in family conversations, guide you through the costs involved, and help you pull everything together into a plan.

Planning for care is unique to your situation, and we can help whether you have questions about Medicare, long-term care insurance, or saving for the future. That way, you’ll feel more prepared for whatever comes next.

TIP: We’re here to help you plan. You can contact us at 1-800-FIDELITY (800-343-3548).

Want to learn more? Check out a replay of our Women Talk Money discussion about creating a roadmap for the costs of caregiving.